Try our demo online freely >

The online demo includes “Accounting for WooCommerce” and “Bank Journal Module.”

Establish a simple or detailed accounting, depending on your needs.

Your simplified accounting

Define only general codes for each type of accounting information: products, taxes, shipping costs, payment methods, accounting ledger, cost accounting.

Your detailed accounting

Need to integrate your detailed chart of accounts? Define detailed accounting codes for each product, taxes, shipping costs, payment methods, accounting ledger, and cost accounting codes.

Export whatever you want to wherever you want!

- Export to leading market solutions: CIEL, Cogilog, EBP Accounting, GNUcash

- Export your assets and orders, by payment type, status, date(s), etc. .

- Export all the fields you need for your accounting: invoice number, discount coupon, payment, order items, shipping type, VAT type, etc.

- A specific export? Configure your export field by field to adapt it to your software.

WooCommerce Settings: Synchronization between tables

First and foremost in WooCommerce > Settings > Advanced > Features (the last one). The options are at the top: “High Performance order storage (recommended)” and “Enable compatibility mode (synchronizes orders to the posts tables)”.

If these options are not present, it is possible that your WooCommerce is not up to date or that the option has a different name, such as “Enable accounting mode.”

Here is a link to help you https://woocommerce.com/document/high-performance-order-storage/

Settings: enter your accounting information

Into Woocommerce settings, you now have a tab Accounting.

A second level of tabs (text, in blue) allows you to navigate between the different settings.

General settings

You can determine the accounting and analytical codes:

- depending on the order status

- default codes for products

- default codes for customers

- default codes for taxes

- default codes for coupons

- default codes for the sales log

- the description prefix

- codes for extraordinary income and expenses

- export settings

- column header names

- column header names

In the export columns, you can use empty columns (empty1 to empty4) to match the format expected by your accounting software exactly.

Settings: Country codes

You can determine specific accounting codes for each country..

To do this, you must have enabled delivery for the list of countries to be displayed. even if your site does not use delivery.

Specify in the WooCommerce settings: “Deliver to all countries where you sell.”

Settings: Tax codes (VAT)

You can determine specific accounting codes for each type of Taxes:

- debit and credit accounts

- tax debit and credit accounts for remittances

Settings: Shipping Codes

You can determine specific accounting codes for each type of delivery, and for each Delivery Zone.

Settings: Codes by payment method

You can determine specific accounting codes for each type of payment method .

Sales Log Settings

A bank journal is added for bank reconciliation.

It adds financial transaction lines to the export file of Accounting for Woocommerce.

Payments are aggregated by date or according to the following cases:

- If you have the extension Sepa Direct Debit : by XML export date

- If you have an online payment via Paybox : by remote collection date

- If you have the extension Bank Slip for WooCommerce : by delivery note

IMPORTANT: This tab will only appear if you have also purchased the add-on. Bank Journal Module – Accounting for WooCommerce.

Export to your accounting software

To export your orders to your accounting software (EBP, Ciel, or other), simply go to “WooCommerce > Accounting Export.”

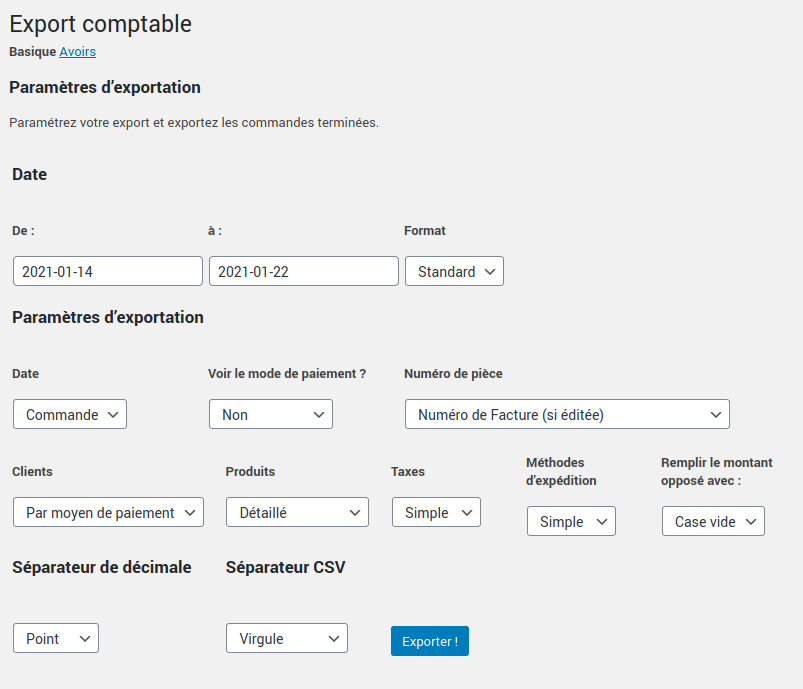

Configure your export

You can then choose what you want to export:

IMPORTANT :

For each criterion, you can specify whether you want to whether the accounting codes are detailed or not.

Exemple :

• If you choose " Simple " in the Tax selector, all VAT amounts will be aggregated into a single accounting code.

• If you choose " Detailed " in the Tax selector, Each type of VAT will appear in the export with its own accounting code (which you will have specified in the settings).

Here are all the export criteria you can configure:

- Start and end date of export, by selecting the date format

- Date : ordering, validation, payment, billing

- View the payment method, or not

- Number of piece (invoice or order number)

- Customers (by customer or by payment method)

- Products (simple or detailed)

- Taxes (simple or detailed)

- Shipping methods (simple or detailed)

- Fill in the opposite amount with: empty box or “0” (according to your import preferences in your accounting software)

- Decimal Separator Type (period or semicolon)

- CSV separator (comma, semicolon, or tab [used for TSV format])

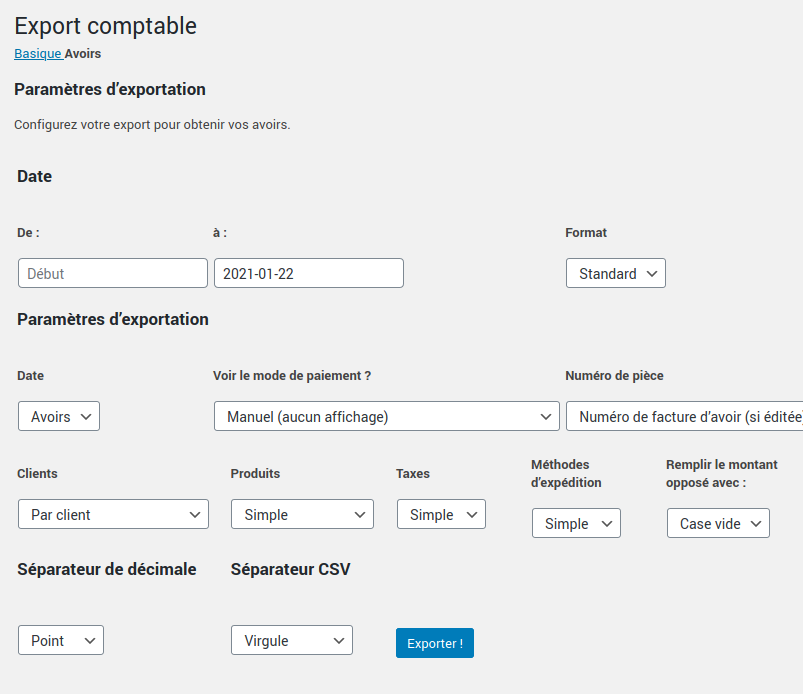

Export your assets

You can also export your credit notes to your accounting software by clicking on the “Credit Notes” tab (at the top of the page).

Try our demo online freely >

The online demo includes “Accounting for WooCommerce” and “Bank Journal Module.”

Would you like more information about the features of the plugin ?

View product sheet

Accounting for WooCommerce – Pro Module 1.7.0

Everything you need to transfer your sales from Woocommerce to accounting software!