Generate tax receipts

Tax receipts can be exported once a year to generate two CSV exports for a mail router, and as many times as necessary for a user.

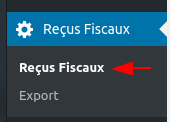

Settings and annual export can be found in the Tax Receipts section.

Settings

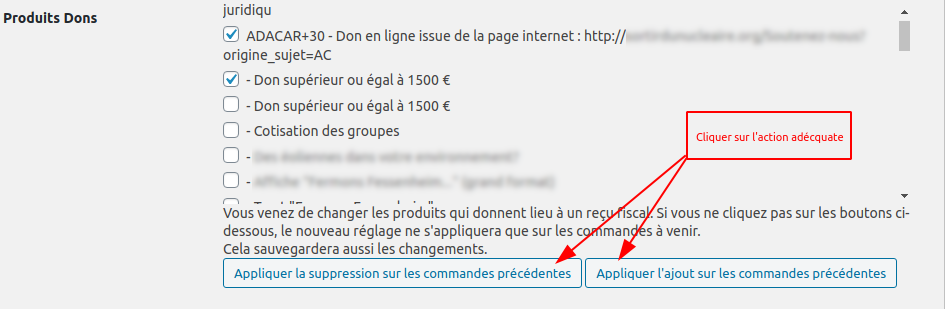

Products Donations

You must check all products that may give rise to a tax receipt. This setting is not retroactive (only valid for future orders) unless explicitly requested.

With each change in the list, two buttons appear

- Apply deletion to previous orders If you click here and have deselected products, then all newly deselected products from orders placed (as of today's date) will no longer be considered products giving rise to a tax receipt.

- Apply the addition to previous orders : If you click here and have checked new products, then all newly checked products from orders placed (as of today's date) will be considered products giving rise to a tax receipt.

If you do not click either button, only future orders will be affected by your changes.

Address Status and Choice of Postal Address

Address statuses are retrieved from CiviCRM. The selected address statuses correspond to the addresses that will be searched for each user; addresses with a status that is not checked are ignored.

After retrieving the user addresses corresponding to the selected statuses, the addresses are scanned and retained in this order:

- If an address is tagged as Tax Receipts, it takes priority.

- Regardless of the tag, the second one is the one marked as the primary address.

- Then the tag “Home” is considered the third choice

- Then the first address corresponding to the checked statuses is selected

If no address matching these criteria is found for the contact, it will be excluded during export.

Greetings

This is the term used to fill in the CSV in the form: “Hello Peter.”

Deduction

This is the percentage deduction that applies to the amount shown on the tax receipt.

Minimum cumulative amount

This corresponds to the minimum annual donation required for a tax receipt to be issued.

If the minimum is set at 10 and a user has donated 5 once and 6 once during the year, then they will receive a receipt.

Order statuses to include

This selects the status of orders that must be scanned for products that require a tax receipt.

Notification email

Since exports take quite a long time to generate, you can enter your email address here to be notified when the export is complete.

PDF Templates

Two templates (to date) are provided by default:

- the official CERFA 11580-04 form

- a simple template based on CERFA 11580-03

Apply the template you want.

You can add templates from your own theme by adding one HTML file per template, in a folder called fiscal_receipt_templates.

You can then modify it to keep only the information relevant to your organization.

Changes you make in the online editing area are saved, but do not overwrite the templates.

If you create a beautiful template, feel free to send it to us, and we will add it to the plugin!

PDF contents

Available mail merge values

This is the content used to generate the one-time tax receipt. It can be composed of variables that are replaced depending on the user for whom it is generated:

[last_name]

Customer billing name

[first_name]

Customer billing name

[company]

Client's billing company

[br_name]

Customer's last name, first name, and billing company, on two lines

[br_address]

Customer billing address, one line per piece of information

[no_br_address]

Customer billing address, on a single line

[address_1]

Customer billing address line 2

[address_2]

Customer billing address line 1

[postcode]

Customer billing postal code

[city]

Customer's billing city

[state]

Customer billing region

[country]

Customer's billing country

[date_letter]

Export date in letters (February 20, 2022)

[date]

Date de l’export (20-02-2022)

[receipt_year]

Year of export

[receipt_id]

Tax Receipt Number

[total_devise]

Total donations for the selected year in letters with currency

[total_letter]

Total donations written in French

[payment_gateways]

List of payment methods used by the customer during the selected year

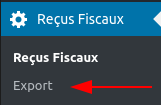

Exports

In the WordPress admin menu, go to " Tax Receipts > Export"

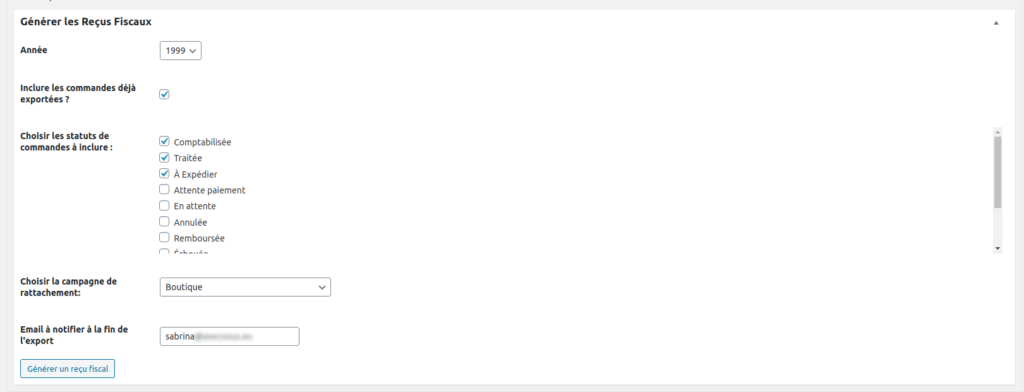

Year

You must select the year of export. For 2021, for example, exports will be made on orders placed between January 1, 2021, at 12:00:00 a.m. and December 31, 2021, at 11:59:59 p.m.

Orders already exported

It is possible to include or exclude donations that have already been exported.

Order statuses to include

This selects the status of orders that must be scanned for products that require a tax receipt.

Linking campaign

An activity will be created in CiviCRM for sending tax receipts to each person, allowing you to keep track of them. You must select the corresponding campaign (created in CiviCRM).

Notification email

Since exports take quite a long time to generate, you can enter your email address here to be notified when the export is complete.

This is a test

This box is checked by default. This allows you to create a dummy export, which will appear in the list of exports at the bottom of the page, but no activity will have been created for users and no tax numbers will have been incremented.

If this box is unchecked, then

- tax numbers will be incremented

- an activity is created for each user concerned.

- a note is added to the order

- the PDF receipt has been generated and can be retrieved from the user's file.

These actions are not reversible.

Previous Exports

Previous exports are listed at the bottom of the page with the following columns:

- Identifier: the export identifier, as well as links to the export of direct debit donations and one-time donations at the end of the export.

- Date: date of export

- Options: a reminder of the options selected for this export, order statuses, year, and whether or not to include orders that have already been exported.

- Number of lines: the number of emails calculated

- Number of Orders: the number of orders affected calculated

- Total Amount: the total amount calculated

Please note that the number of lines, orders, and total amount are calculated using orders that meet the export criteria. Before creating the CSV file, the number of lines will decrease because users without a valid address and those who do not have a high enough cumulative minimum to receive a tax receipt must be removed.

File cleanup

You can delete the Year Folders and their contents.

Warning: this is final, and will result in the absence of a link to individual tax receipts in the user profile.

You can regenerate individual tax receipts by performing a new export with the same options.

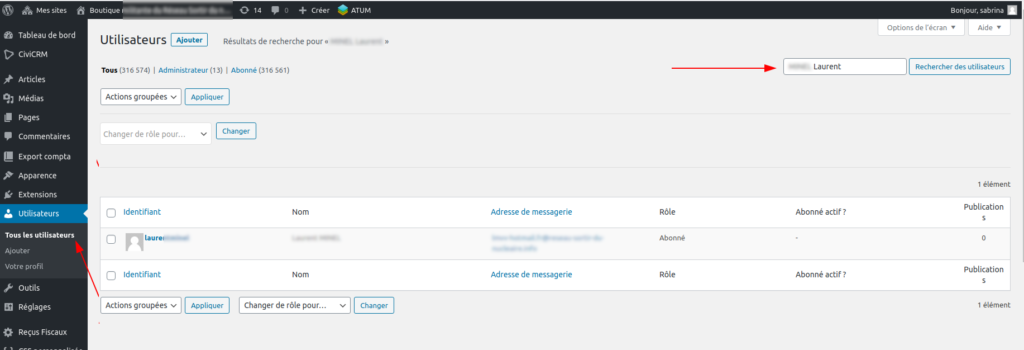

One-time tax receipts

To generate a one-time export, go to the user's profile page by searching for the user in the WordPress Users list, then clicking on Edit.

Scrolling down the page brings you to the Tax Receipts section, which is collapsed.

It consists of the receipt table and, below that, the form for generating a new one.

It works in the same way as the annual export, but it automatically writes to the database. It will open a PDF generated from the content entered in the settings in a new tab.

Tax Receipt Numbers

Tax receipt numbers are linked to a person, an amount, and a year. This means that if there was a one-time tax receipt before the annual export:

- If the amount remains the same, the tax receipt number is retained.

- If the amount is no longer the same, the tax receipt number is regenerated.

[Soon– contact-us] CiviCRM Features

Address Status and Choice of Postal Address

Address statuses are retrieved from CiviCRM. The selected address statuses correspond to the addresses that will be searched for each user; addresses with a status that is not checked are ignored.

After retrieving the user addresses corresponding to the selected statuses, the addresses are scanned and retained in this order:

- If an address is tagged as Tax Receipts, it takes priority.

- Regardless of the tag, the second one is the one marked as the primary address.

- Then the tag ‘Home’ is considered the third choice

- Then the first address corresponding to the checked statuses is selected

If no address matching these criteria is found for the contact, it will be excluded during export.

Greetings

This is the term used to fill in the CSV in the form: ‘Hello Peter’.

Deduction

This is the percentage deduction applicable to the amount shown on the tax receipt.

Linking campaign

An activity will be created in CiviCRM for sending tax receipts to each person, allowing you to keep track of them. You must select the corresponding campaign (created in CiviCRM).

Would you like more information about the features of the plugin ?

View product sheet

Tax receipts for WooCommerce 1.1.2

With this plugin you can generate tax receipts in PDF and CSV, in bulk or per user/order.